2023 Form 941- Instructions and Information

Line by Line Instructions Explained

When is Form 941 Filing Due Dates for 2023 Tax Year?

Deadline to file Employer's Quarterly Federal Tax Return

2023 First Quarter

January, February, March

Due on May 1st, 2023

2023 Second Quarter

April, May, June

Due on July 31st, 2022

2023 Third Quarter

July, August, September

Due on October 31st, 2023

2023 Fourth Quarter

October, November, December

Due on January 31st, 2024

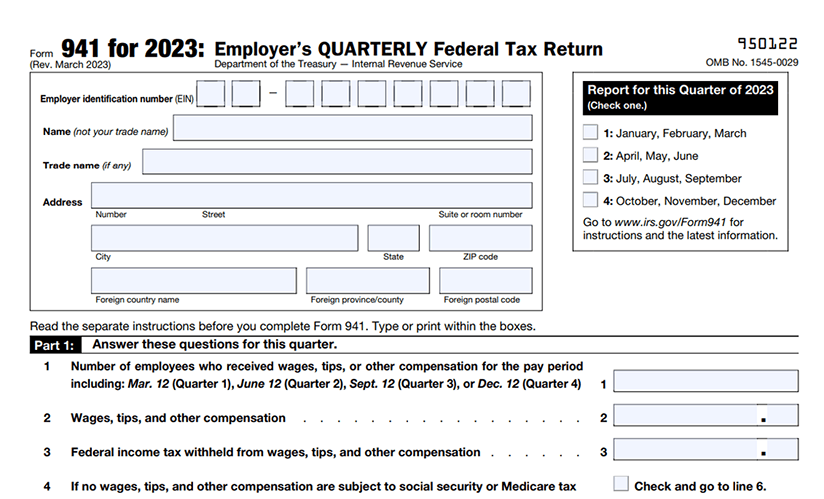

What is the IRS Form 941?

Employer's Quarterly Federal Tax Return

If you are a business owner and have employees working for you, then you need to file IRS Form 941, Employer’s Quarterly Federal Tax Return, every quarter. As an employer, you are responsible for withholding federal income tax, social security, medicare and other payroll taxes from each employee’s wages and remitting it to the IRS. For calculating credits and tax liability Form 941 Worksheet 1 and Schedule B can be used.

Visit https://www.taxbandits.com/form-941/what-is-form-941/ to learn more about

IRS Form 941.

Line by Line Form 941 Instructions

-

Line 1

Enter the number of employees, who got wages, tips, or other pay in the particular quarter

-

Line 2

Enter the complete wages, tips, paid and other pay to your employees

-

Line 3

Enter the federal income tax withheld from the employee’s paycheck

-

Line 4

Check this box if wages are not subject to social security and medicare tax. And if it doesn't apply, please skip this line

-

Lines 5a, 5a(i) and 5a(ii)

The taxable qualified sick and family leave wages taken after March 31, 2021 should be entered on 5a. On line 5a(i) and 5a(ii) employers should enter qualified sick and family wages that were given after March 31, 2020 for leave taken before April 1, 2021.

-

Line 5b-Taxable social security tips

Enter the tips reported for all your employees during the quarter Line 5b = Column 1 x 0.124 = Column 2

-

Line 5c - Taxable Medicare wages & tips

Enter the wages, tips, that are subject to medicare tax

Line 5c = Column 1 x 0.029 = Column 2 -

Line 5d - Taxable wages & tips subject to Additional Medicare Tax withholding

Enter all the taxable wages & tips subject to Additional Medicare Tax withholding Line 5d = Column 1 x 0.009 = Column 2

-

Line 5e - Total social security and Medicare taxes

Sum of Column 2 from Lines 5a, 5a(i), 5a(ii) 5b, 5c and 5d.

-

Line 5f - Section 3121(q) Notice and Demand-Tax due on

unreported tipsEnter the tax due that you have received from the Section 3121(q)

Notice and Demand -

Line 6 - Total taxes before adjustments

Enter the sum of line 3, 5e, and 5f

-

Line 7 to 9 - Tax Adjustments

Enter the Adjustment for a fraction of cents (Line 7), sick pay (Line 8), tips and group life insurance (Line 9)

-

Line 10 - Total taxes after adjustments

Enter the sum of line 6 to line 9

-

Enter the qualified small business payroll tax credit for increasing

research activitiesEnter the amount calculated in Form 8974 and attach.

- Line 11b - Enter the nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

- Line 11c - Enter the nonrefundable portion of employee retention credit

- Line 11d - The nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021

- Line 11e - Enter the nonrefundable portion of COBRA premium assistance credit

- Line 11f - Enter the number of individuals provided COBRA premium assistance

- Line 11g - Enter the total nonrefundable credits by adding lines 11a, 11b, 11c, 11d, and 11e

- Total taxes after adjustments by subtracting line 11g from 10

-

Line 13a

Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter

-

Line 13b - Reserved for future use

This was previously used for entering deferred amount of social security tax. Now it is reserved for future use.

-

Line 13c - Refundable portion of credit for qualified sick and family leave wages from Worksheet 1

Use Worksheet 1 to calculate the refundable portion of credit for qualified sick and family leave wages and enter the amount.

-

Line 13d - Refundable portion of employee retention credit

from Worksheet 1Enter the amount of refundable portion of employee retention credit which was calculated on worksheet 1.

-

Line 13e - Total deposits and refundable credits

Enter the total refundable credits by adding 13a, 13c and 13d.

-

Line 13f - Total advances received from filing Form(s) 7200

for the quarterEnter the total amount of advances received from filing Form 7200.

-

Line 13g - Total deposits and refundable credits less advances

Subtract line 13f from line 13e and enter the amount.

-

Line 14- Balance due

Enter the difference, If line 12 is more than the line 13g.

-

Line 15- Overpayment

Enter the difference, if line 13g is more than line 12. Choose either box, Apply to the next return or send a refund as you prefer.

First, complete your basic Form 941 details in

Box 1 - Entering Employer Details - EIN, name, business name, and address.

Box 2 - Choosing Quarter - choose a quarter for which Form 941 is being filed.

Employer's Quarterly Federal Tax Return

-

Line 16

Tax Liability for the Quarter. If Line 12 on your Form 941 was less than $2,500, the previous quarterly return was less than $2,500, and there was no next-day deposit obligation for $100,000, you can check the box on Line 16 and move to Part 3. Line 16 is also where you will determine if you are a semiweekly or monthly depositor.

Click here to know more about IRS Form 941 line by line Instructions

Part 2 - Deposit schedule and tax liability for

the quarter

-

Line 17 - If your business has closed or you stopped paying wages

If your business was closed or you stopped paying wages in the quarter, check on line 17 and enter the final date when you paid wages.

-

Line 18 - If you are a seasonal employer and you don’t have to file a return for every quarter of the year

If you are a seasonal employer and don’t have to file Form 941 every quarter, then check the box underline 18.

-

Line 19 - Qualified health plan expenses allocable to qualified sick leave wages

Enter the qualified health plan expenses allocatable to qualified sick leave wages and also need to enter this total on Worksheet 1 - Step 2, line 2b.

-

Line 20 - Qualified health plan expenses allocable to qualified family leave wages

Enter the qualified health plan expenses allocatable to qualified family leave wages and also need to enter this total on Worksheet 1 - Step 2, line 2f.

-

Line 21 - Qualified wages for the employee retention credit

Enter the qualified wages for the Employee Retention Credit and also need to enter this total on Worksheet 1 - Step 3, line 3a.

-

Line 22 - Qualified health plan expenses allocable to wages reported on line 21

Enter the qualified health plan expenses for the Employee Retention Credit. This total is also entered on Worksheet 1- Step 3, line 3b.

-

Line 23 - Credit from Form 5884-C, line 11, for this quarter

Enter the credit amount from the line 11 of Form 5884-C

-

Line 24

Enter the Qualified health plan expenses allocable to qualified sick leave wages reported on line 23

-

Line 25

Enter the amounts under certain collectively bargained agreements allocable to qualified sick leave wages that are reported on line 23

-

Line 26

Enter the qualified family leave wages for leave taken after March 31, 2021

-

Line 27

Enter the qualified health plan expenses allocable to qualified family leave wages reported on line 26

-

Line 28

Enter the amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 26

Part 3 - About your business

Part 4 - Third-party designee

First, complete your basic details in

Check “Yes”, If you wish to discuss this return with the IRS and provide the designee name and phone number. Also, enter the 5 digit pin to use while talking with the IRS.

Check “No”, if you don’t wish to discuss it.

Part 5 - Signature

Once each and every part is completed, you are required to sign Form 941.

The following persons are authorized to sign the return for each type of business entity.

- Sole proprietorship: Individual who owns the company

- The corporation or an LLC treated as a corporation: President, vice president, or another principal officer

- Partnership or an LLC treated as a partnership Partner, member, or officer

- Single-member LLC: Owner of the LLC or a principal officer

- Trust or estate: The fiduciary

Paid Preparer Use Only

- Form 941 must be signed by a duly authorized agent of the taxpayer if a valid power of attorney has been filed.

- If the form is prepared by the paid preparer, enter their information such as name, signature, address, PTIN, and contact number.

Visit, https://www.taxbandits.com/form-941/form-941-instructions/ to learn more about IRS Form 941 line by line Instructions.

What are the COVID-19 changes in IRS Updated Form 941?

IRS released a new Form 941, Employer’s Quarterly Federal Tax Return for 2021, and updated instructions to reflect the effects of COVID-19.

For Second Quarter, 2022

The IRS revised the payroll tax Form 941 for the second quarter of 2022. The changes made reflect the ending of the COBRA Premium Assistance Credit program.

Lines 11e, 11f, 13f, which have been used to report COBRA Premium Assistance Credit are “Reserved for future use”. The tax relief programmes established by the American Rescue Plan Act will continue to expire in the second quarter of 2022, and these changes will be reflected on Form 941. As a result, for the second quarter of 2022, the COBRA Premium Assistance Credit will be unavailable.

Click here to learn more about the Q2 Form 941 changes.

For the Third & Fourth Quarter, 2020

Form 941 is going to be revised a bit to accommodate the aspects released in the presidential memorandum. This memorandum says that employers will now be allowed to defer the employees’ share of Social Security Tax. The changes affect lines 1, 13b, 24, and 25 of Form 941. E-file Form 941 for the third and fourth quarters here.

Click here to know more about 2020 Form 941 third and fourth quarter changes.

https://www.taxbandits.com/form-941/irs-revised-form-941-for-3rd-and-4th-quarters/

For Second Quarter, 2020

The updated new form 941 addresses the economic impacts of COVID-19 by allowing qualifying employers to defer deposits on their payroll taxes, apply for Payment Protection Program (PPP) loans, obtain employment tax credits, and claim payments towards advance credits. Employers will be required to use the new 2020 Form 941 when they submit their second-quarter filing to the IRS.

Click here to know more about 2020 Form 941 COIVD changes.

How to File Form 941 Electronically with the IRS?

Step 1

Step 2

Step 3

File Form 941 at just $4.95/return

Pricing includes Schedule B (Form 941), Form 8453-EMP, and Form 8974

Contact Us

Our support team is ready to assist you all the time.

Just contact us through phone 704.684.4751 or by email support@taxbandits.com

IRS Authorized

IRS Authorized